Credit score is a number from 300 - 850 that represents the probability that you will pay your bills on time. Your credit score is primarily based on your credit history --- or the history of your credit payments, the amount of debt that you have, and how long you have had your credit card. A higher credit score means that you have a better credit history, and a lower credit score means you have a slightly worse credit history. There are several scoring models that are used while calculating your credit score, using several different factors.

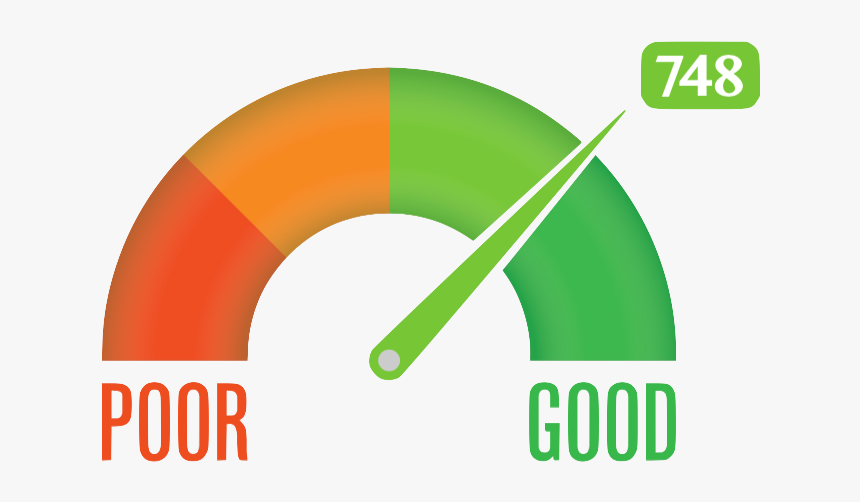

Your credit score is assigned to the following general ratings: .jpg?h=873e8429b534d745687d50e4d112c06e)

How to Build a Good Credit Score

Building a good credit score will take time, especially with your first credit card, so it’s best to start making the right credit card decisions to set yourself up for financial success in the future. Always, always, always pay your bills on time! That is one of the most important aspects to building a good credit history. To be able to do this, never spend more than you make in a month. You can read about how to make a budget here, which will help make sure that you never overspend your credit. Starting from a young age, and just doing this consistently, over time, will help you build a good credit score over time. If you are unable to pay your credit card bill in full, at least make the minimum payment to pay off your debt, otherwise, you will be seriously damaging your credit score.

So why is it so important to build a good credit score? Having a high credit score means that you will be eligible for better credit terms. You will be able to receive better rates in the future when you are taking out a house mortgage or car loans. It will help you in renting an apartment, taking out loans, and some employers can even look at your credit score. Better credit terms can mean lower payments and lower rates of interest, which will save you a lot of money over the course of your life.

In the long run, building up a strong credit history will save you a lot of money and give you a lot more financial opportunities to look forward to. A solid credit score is a great first step to attaining financial success in your future. Make it a priority.